WHO WE ARE

Founded in 2021, Cornerstone Finance Group is a dynamic UK-based financial services group that empowers mortgage and protection advisers while delivering comprehensive financial solutions to clients across the country.

Proudly rooted in Wales with nationwide reach, we’ve grown rapidly by staying at the forefront of innovation, embracing change, and continually enhancing our services to help advisers and clients achieve their financial goals.

WHAT WE DO

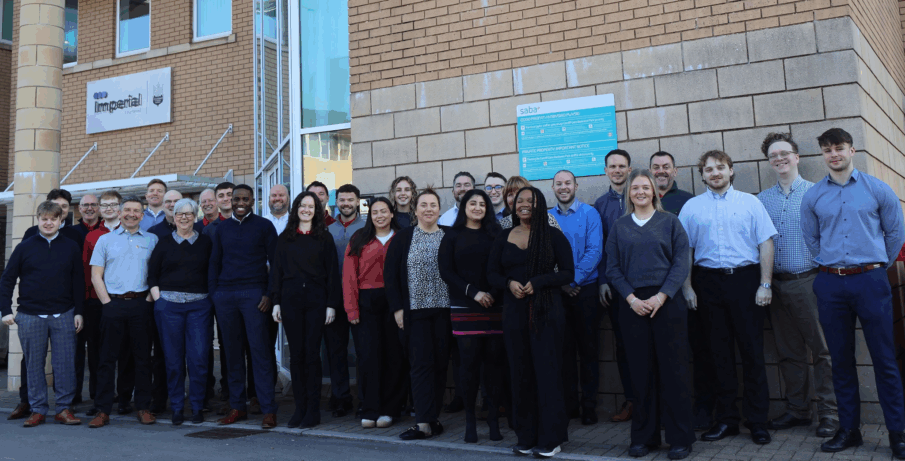

Meet the Team

Our success is powered by our people.

Charity & Community

We’re committed to creating a positive impact, not just for our clients and advisers, but for the wider community too. From supporting local and national charities to volunteering and fundraising across the year, giving back is part of our culture.

Our Mission & Core Values

At Cornerstone Finance Group, our mission is to make financial services simpler, smarter, and more accessible for everyone. We empower advisers to grow independent, successful businesses while ensuring clients across our brands receive trusted, expert financial solutions.

We provide the tools, resources, and flexibility advisers need to succeed on their own terms, without restrictions or unnecessary barriers.

As a young, dynamic company, we embrace change and adopt new solutions quickly, staying ahead in an evolving financial landscape.

We prioritise understanding our clients’ unique needs, offering tailored advice and services to help them achieve their goals.

We invest in lasting relationships with advisers, clients, and partners, focusing on sustainable growth and mutual success rather than short-term gains.