Turn Ambition into Expertise

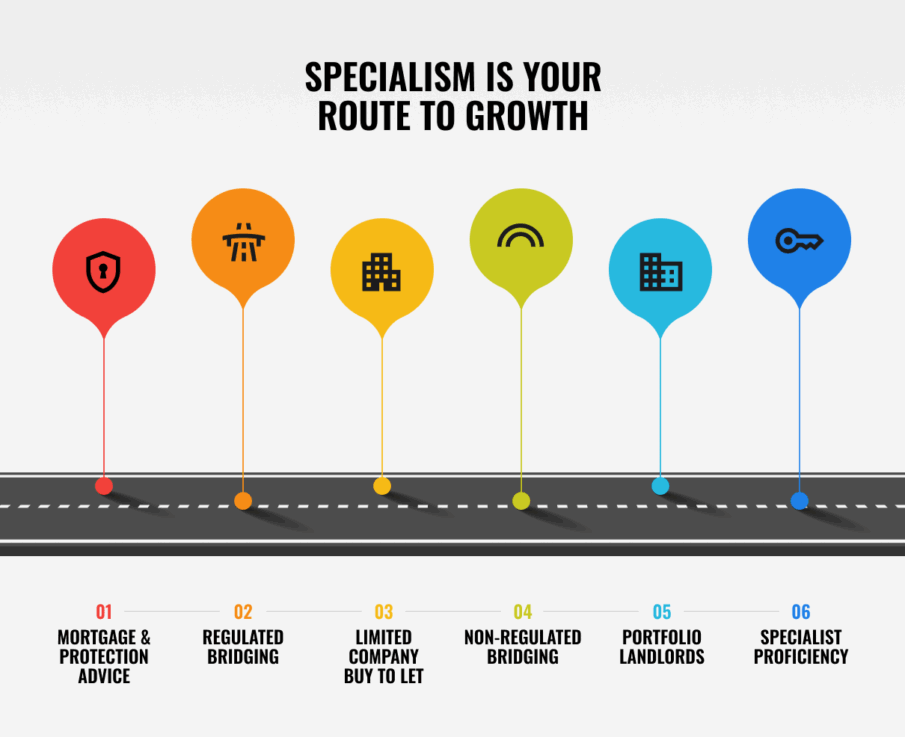

Progress in specialist advice isn’t about leaving the basics behind, it’s about building on them.

At Cornerstone, we help advisers move confidently through each stage of their professional journey, unlocking new opportunities with every step.

Built for Advisers Ready to Grow

Too many networks keep advisers in the slow lane.

The Cornerstone Network gives you the tools and support to grow your income, retain more clients, and move onto a specialist lending pathway with confidence.

- Training and permissions - advance through new specialist advice areas at your own pace

- Specialist product training - commercial, bridging, equity release & more

- Supportive compliance - grow with confidence, not red tape

- Community of experts - collaborate, learn, grow

- Smart client retention tools - CRM designed to keep you front-of-mind

- Multiple income streams - referral opportunities through our Commercial Finance team and trusted partners

Advisers don’t just join. They grow.

How Remoo Mortgages Grew Faster by Thinking Specialist

Discover how Remoo Mortgages transformed from generalist broker to specialist powerhouse by leveraging the full support of the Cornerstone Network.